Meet the Cash App

Like Venmo before it, Cash App by Square is a mobile payment app ideally suited for millennials or anyone else who rather not carry bills (or coins) around like it’s 1985. Instead, payments between peers are completed using a mobile app. Unlike similar products, Cash gives you the ability to receive direct deposit payments to your bank account. You can also buy and sell Bitcoin through the app.

Sending and Requesting Money

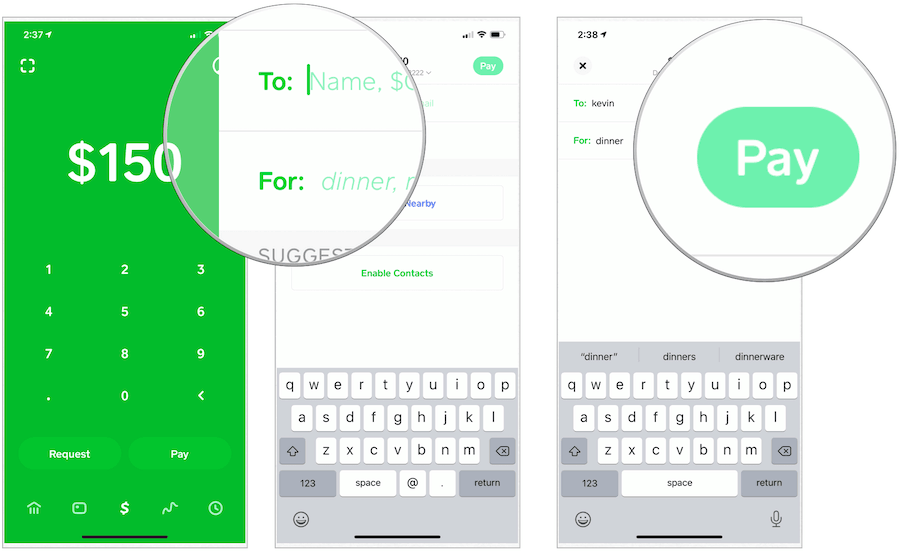

To get started download the Cash app on your iOS or Android device. Then you’ll need to enter your mobile number or email to create a unique username that the company dubs “$Cashtag”. Choosing a $Cashtag automatically creates a shareable URL (https://cash.app/$yourcashtag) where friends, family, and customers can make payments to you privately and securely. From there, you’ll be asked to link your bank account or debit card information. Honestly, the setup is that simple. To send cash:

By default, the money to send will come out of your Cash balance. Otherwise, it will select your non-Cash debit card. If your recipient doesn’t use Cash, that’s fine. They’ll receive a text or email when receiving a payment. From there, they’ll need to enter a bank account or debit card information to receive the Cash. Asking someone for money works very similarly to sending Cash. To request payment:

Making Payments by Scanning

The Cash app also offers a scanning option that allows customers in the same location to send or receive money.

What is the Cash Card?

There are times when going old school is still necessary, and that’s where the Cash Card comes in. The free Visa debit card lets you pay for goods and services from your Cash App balance. It’s not connected to your bank account or non-Cash debit card. Compatible with both Apple Pay and Google Pay, the Cash Card is available in black or white. You can personalize your card by adding a signature or what’s best described as doodle art to the front. Yes, it’s gimmicky, but that’s okay. You must be 18 or older to apply for a Cash Card. Cards should arrive within 10 business days.

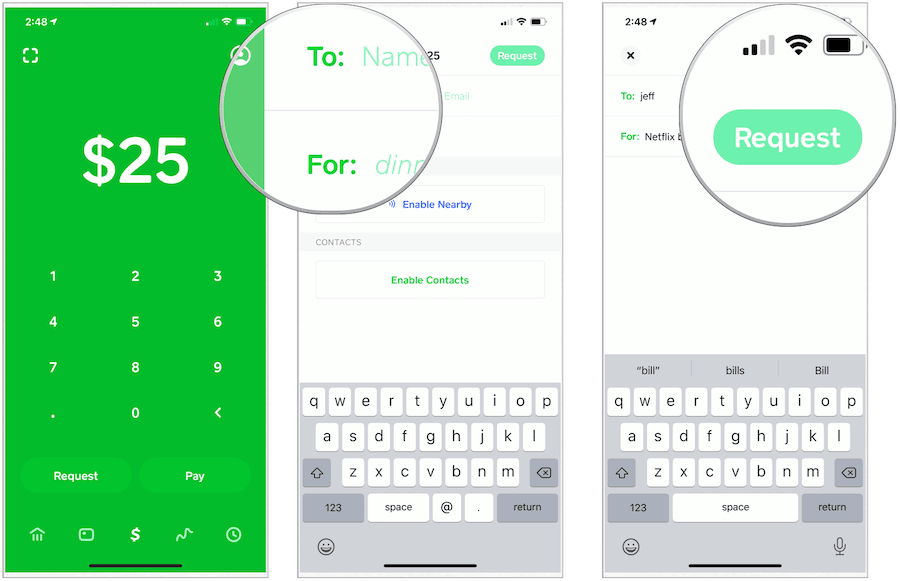

Get a Boost

With Cash Boost, you receive instant cashback for purchases made with the Cash Card. To do so, you select from the list of retailers offering a Boast from the Cash App before making a purchase. At the time of this writing, Panera, Five Guys, Whole Foods, and other retailers offer Boosts. You can only use one Boost at a time, and they can only be swapped every 24 hours.

Bitcoin

If you’ve been curious about buying and selling a cryptocurrency, but thought it was a complicated process, the Cash App has come to the rescue thanks to Square. With the app, you can get into the game in a fast, simple way by buying and selling bitcoin. The first of the many cryptocurrencies now available, bitcoin creates, holds, and transfers value based on equations and codes that ensure that transactions can only be completed once. Although Coinbase is our go-to for Sending/Receiving/Trading Bitcoin, Square’s Cash App one-stop-shop access to cash and Bitcoin makes it an attractive option. To deposit bitcoin into your Cash App: The Cash App has a deposit limit of $10,000 worth of bitcoin over seven days.

Direct Deposit

Yes, you can ditch your traditional bank and sent your direct debit to the Cash App. By doing so, you can send or spend money from your paycheck using the Cash App or Cash Card. To get started: Note: You need an activated Cash Card to enable direct deposits. Right now, you can’t use your routing and account numbers for bill paying, although it’s a feature that could eventually get added.

Fees

The current fees for using the Cash App are as follows: For new account holders, you can send up to $250 within any seven days and receive up to $1,000 within any 30 days. To increase these limits, you have to confirm your identity. Once verified, the sending limit rises to $2,500 per week; there’s no limit on the amount of cash you can receive. Beyond this, there’s never a fee to send money to your Cash App balance when using your bank account. Instant transfers from your debit card, however, cost 1.5 percent of your transaction. ATM withdrawal limits are $250 per transaction, $1,000 in any 24 hours, $1,000 in any seven days, and $1,250 in any 30 days. Cash Cards work at any ATM, with a $2 fee charged by the Cash App. Most ATMs will charge an additional fee for using the card. The Cash App reimburses these fees when you establish direct deposits.

Limited Appeal?

If you’re looking for a quick, secure way to send and receive money among family and friends, the Cash App is worth considering. However, I wouldn’t use the Cash App as your everyday bank — at least not yet. Without bill pay functionality for direct deposit, the Cash App isn’t ready for prime time for this purpose. It will be interesting to see how the service evolves in the future.

![]()